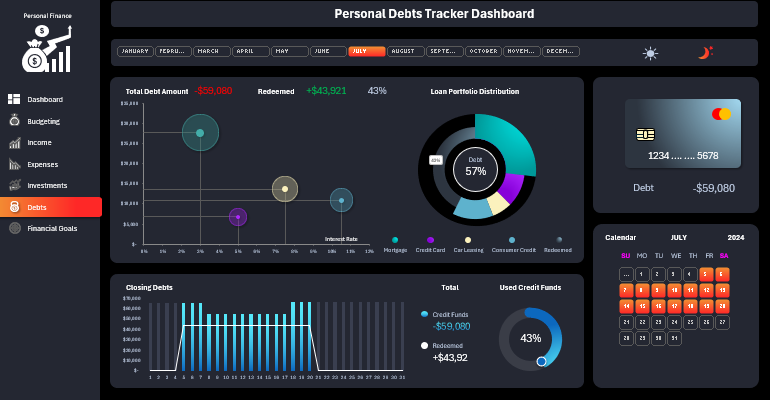

DOWNLOAD a Debt Repayment Tracking Dashboard in Excel

Managing debt obligations is an important step toward financial freedom. With Excel, you can create a convenient dashboard that simplifies tracking all your debts, including repayment schedules and balances. In this video tutorial, you will learn how to create a dashboard for tracking debt repayment in Excel. The video covers how to create a template in Excel to effectively organize your loan data.

Developing a Loan Debt Management Dashboard in Excel

The video demonstrates how to set up repayment charts and automate personal debt analysis.

In this guide, we will show you step by step:

- Creating a pivot table based on initial data.

- Dynamic formulas to extract data from the pivot table.

- How to create a stylish bubble chart template in Excel.

- Formulas for creating a pie chart with a functional design.

- How to create a functional design in Excel for a dynamic chart.

- Adding controls to toggle between months on the dashboard.

- Creating a formula table for analyzing daily loan repayment data.

- Creating a bar chart with the ability to expand data selection in the visualization.

- Adding dashboard control buttons for an interactive calendar.

- A beautiful chart showing the ratio of loan repayments to debt obligations.

- How to build an interactive calendar in Excel.

- A light version of the dashboard design.

- Testing the functionality of all interactive features in the loan debt presentation in Excel.

This template is Example of the personal finance management Excel dashboard.

This is the sixth to last screen of a comprehensive dashboard for personal finance analysis.

This guide will help you visualize the process of repaying personal debts, monitor outstanding balances, and see progress in real-time.

Download debt repayment tracking dashboard template in Excel