How to Calculate Average Salary for Business Trips in Excel

To calculate business trip allowances for an employee, you need to determine the average salary for the preceding calendar year. This figure is then used for subsequent calculations. Working hours are not taken into account; only the actual worked time and earnings matter. How can you calculate the average salary for business trips in Excel?

How to Calculate Average Earnings for Business Trip Compensation

The calculation requires the actual accrued wages. This includes everything an individual is entitled to under the employment contract or agreement: base salary, bonuses, allowances, planned raises, etc. Benefits like material assistance, payment for sick leave, idle time due to employer's fault, etc., are not considered. This means situations where the employee received an average salary without performing actual work are excluded.

Another component of the formula is the actual worked time over 12 full calendar months prior to the month of the business trip. To calculate the business trip allowances, you multiply the average daily earnings by the number of working days (according to the work schedule) during the business trip period.

Examples of Calculating Average Earnings for Business Trips

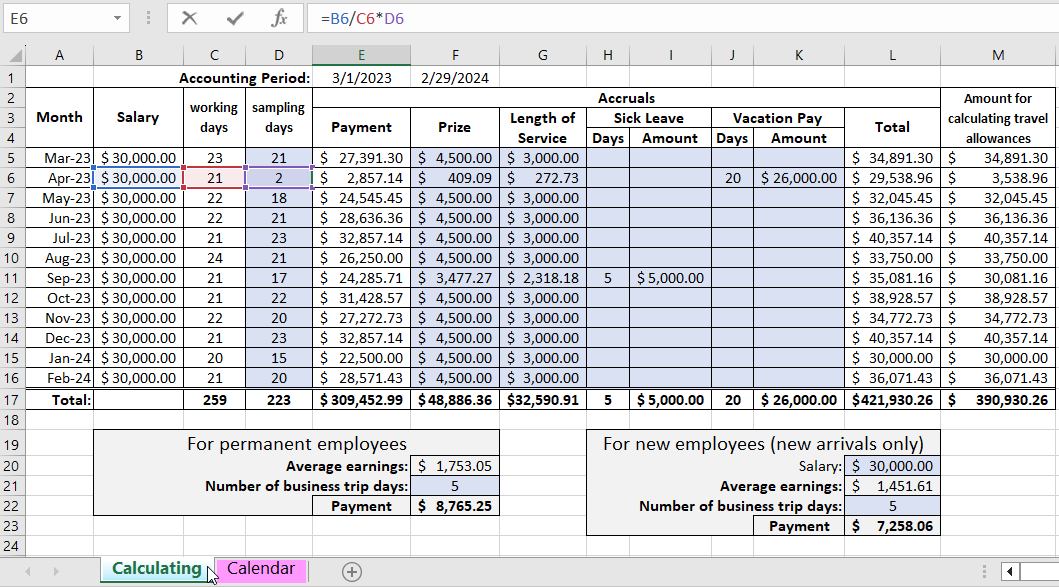

Let's first consider a straightforward example where an employee has a long continuous tenure with the organization. This means that the calculation period includes all 12 calendar months.

Fefelkin I.I. goes on a business trip from March 7, 2025, to March 13, 2025. During the calculation period, he had days of sick leave (5 days in September 2023) and paid annual leave. To calculate the business trip allowances, consider the following amounts:

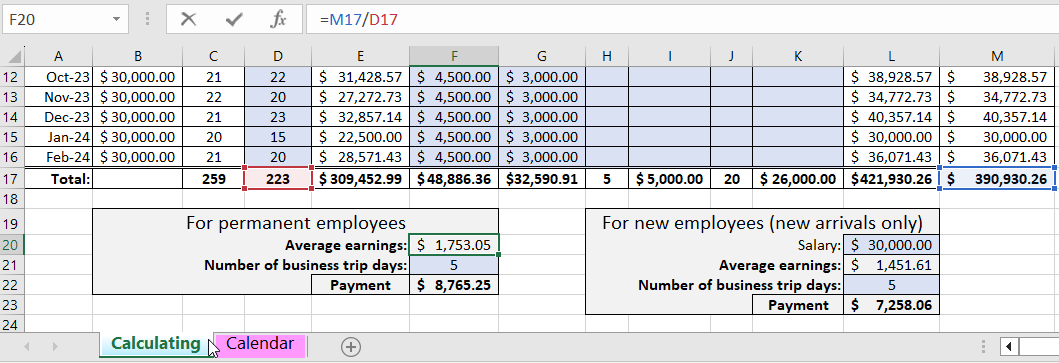

The calculation period is from March 1, 2023, to February 29, 2025. Sick pay and vacation pay are excluded from the calculation. Therefore, the total earnings and the business trip amount differ.

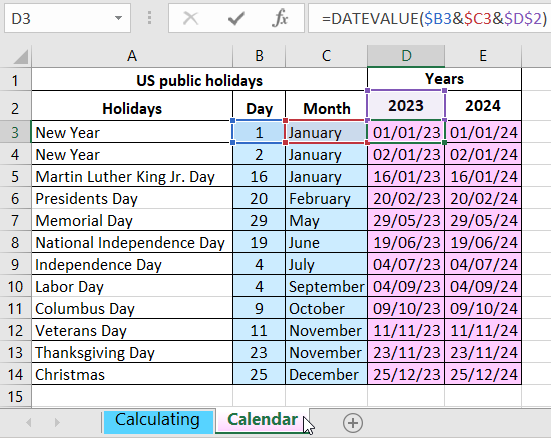

On the second sheet, we indicate holidays for the US Manufacturing Calendar 2024

The Excel formula for calculating average earnings can be found on the first sheet titled "Calculating":

The employee was on a business trip from March 7 to 13. According to the company's work schedule, this amounts to 5 working days and 2 weekends. Weekend work is compensated separately by order (if the person worked on those days).

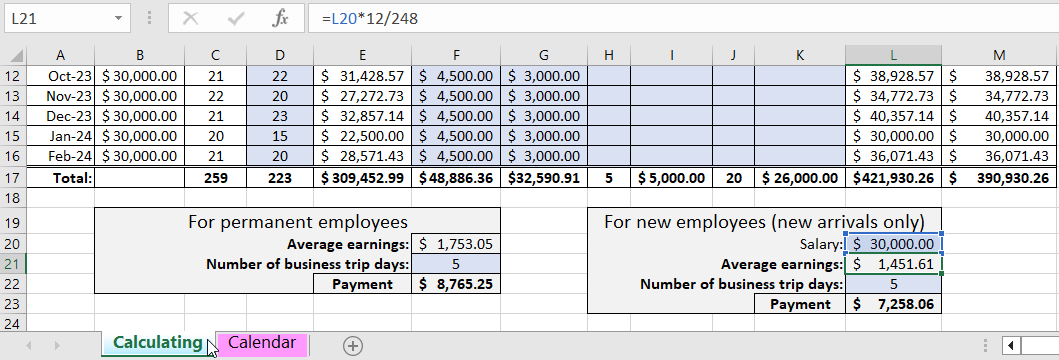

From the first day of employment, the employee goes on a business trip. There are no actual working days or earnings. The contract sets a base salary of 30,000 rubles.

Let's calculate the business trip amount:

Download an example of calculating average earnings for business trips in Excel

Download an example of calculating average earnings for business trips in Excel

248 – the number of working days over the preceding 12 months according to the production calendar.

The employee goes on a business trip from February 22 to March 6, 2025. This spans parts of February and March. Legislation does not explicitly specify how to calculate average earnings in such overlapping situations. Therefore, the accountant can choose the most suitable method without compromising the employee's interests.

You can either calculate separately for February and March or compute for the entire business trip period. By law, one average salary is not included in another. Hence, when using the first method, the business trip amount for February is not part of the earnings for calculating the average daily wage "for March".