How to Calculate EBIT and EBITDA Using Formulas in Excel

Operating profit before tax and interest payments is called EBIT (Earnings Before: Interest, Taxes). Operating profit before interest payments, taxes, and amortization is called EBITDA (Earnings Before: Interest, Taxes, Depreciation, Amortization). These are two very important indicators for analyzing a company's financial performance. Both indicators are calculated by summing certain expenses to the income related to net profit.

Formula for Calculating the EBIT Financial Indicator in Excel

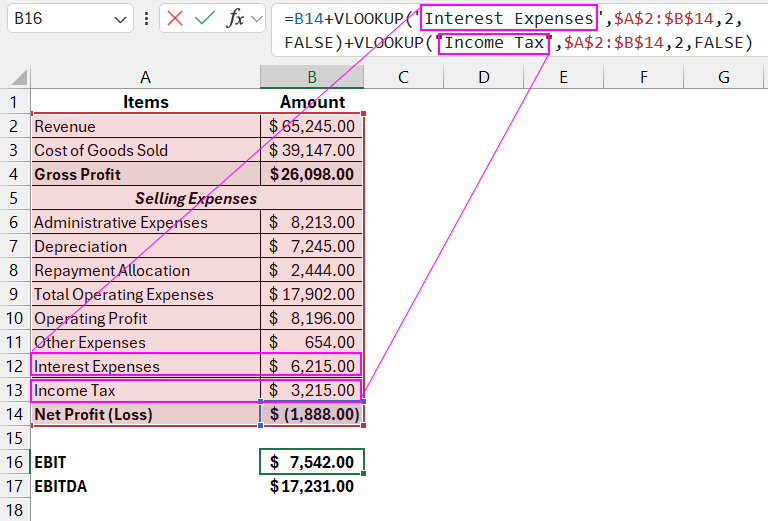

EBIT can be simply represented with a formula in Excel. It is better to see it once than hear it a hundred times. Below is an example of an income and expense statement, followed by a calculation of these financial indicators:

Source data table:

| Items | Amount |

| Revenue | $65,245.00 |

| Cost of Goods Sold | $39,147.00 |

| Gross Profit | $26,098.00 |

| Selling Expenses | |

| Administrative Expenses | $8,213.00 |

| Depreciation | $7,245.00 |

| Repayment Allocation | $2,444.00 |

| Total Operating Expenses | $17,902.00 |

| Operating Profit | $8,196.00 |

| Other Expenses | $654.00 |

| Interest Expenses | $6,215.00 |

| Income Tax | $3,215.00 |

| Net Profit (Loss) | $(1,888.00) |

=B14+VLOOKUP("Interest Expenses",$A$2:$B$14,2,FALSE)+VLOOKUP("Income Tax",$A$2:$B$14,2,FALSE)

The formula calculating the EBIT indicator uses the value from cell B18 and two VLOOKUP functions that search for interest and tax values in the income and expense statement.

Formula for the EBITDA Financial Indicator in Excel

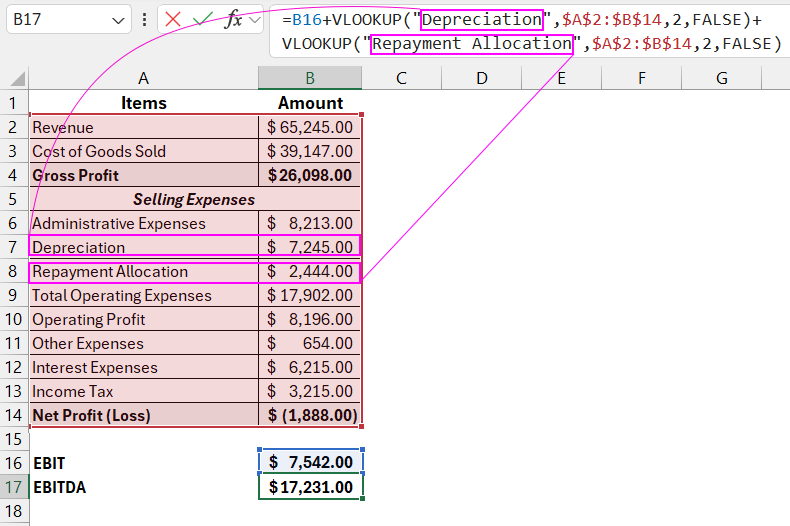

EBITDA can be simply explained with the following image of the formula:

=B16+VLOOKUP("Depreciation",$A$2:$B$14,2,FALSE)+VLOOKUP("Repayment Allocation",$A$2:$B$14,2,FALSE)

Download an example on How to Calculate EBIT and EBITDA Using Formulas in Excel

The formula that calculates the EBITDA indicator uses the EBIT value (B20) and adds back depreciation and interest expenses.

Instead of using standard cell references for the aforementioned expenses, it is better to use the VLOOKUP function. This way, if the structure of the report changes, you won’t need to modify the formulas calculating these financial performance indicators.