Calculation of the financial activity ratio in Excel

The coefficient of financial activity (capitalization, dependence, leverage, leverage) – is the indicator, that is especially important for investors. It characterizes the financial condition of the enterprise, the ratio between its own and borrowed money. More preferable for investments will be the enterprise with a large ratio, but excessively high values will lead to decreasing in profitability and, accordingly, the income of the depositor.

The indicator is also important for creditors. The lower the value, the greater the chance of getting a loan.

The role and the significance of the coefficient of financial activity

The coefficient of financial activity and the leverage of the financial leverage are determined by the ratio of the amount of all financial resources to the amount of available funds at their disposal.

The coefficient of financial activity shows how much the company depends from the external sources of financing; how many rubles of «foreign» funds account for the ruble of their own. And also the ability of the enterprise to return in full the accounts payable at the expense of its assets (in case of their sale).

The coefficient is directly influenced by the following indicators:

- the total value of the assets of the enterprise;

- the amount of non-current and current assets;

- the amount of sources of own capital, borrowed funds, working capital;

- the amount of uncovered losses.

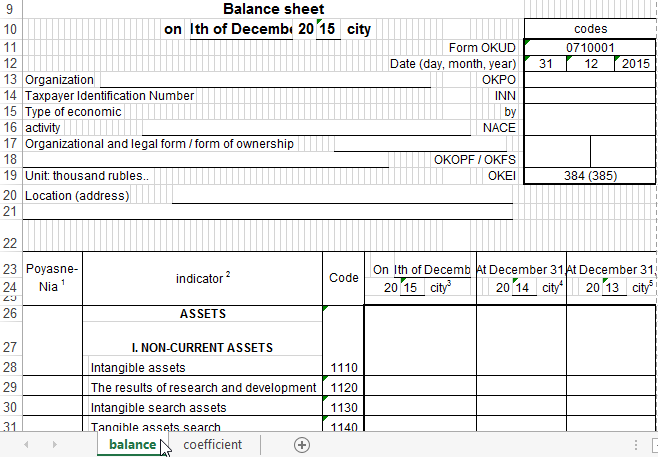

The information base for calculating the coefficient of financial activity - there is the financial accounting.

The general formula:

The Coeff. fa = total cost of the company's financial resources / sources of own funds (SF)

where SF – is the net worth.

The formula by balance:

The Coeff. fa = balance currency / total of the 3-d section of the balance sheet.

The indicator of financial activity is high under such circumstances:

- the increase of the balance sheet at the end of the reporting period (if compared with the beginning);

- the value of working capital increases faster than non-current assets;

- the value of own funds is growing faster than borrowed funds;

- the growth rate of receivables and payables is approximately the same;

- the absence in the balance sheet of the article «Uncovered loss».

There is positive trend in the work of any enterprise – is decreasing in the coefficient of financial dependence. The company should strive to increase the share of its own funds to ensure the stability of the operation. The increase in the total cost of financial resources is also positively assessed by attracting low-cost borrowed capital.

The coefficient of financial activity: the formula for balance in Excel

The enterprise makes a balance in Excel.

It is necessary to calculate a balance at the end of 2015. The expanded formula (without «binding» to the numbers of the balance lines):

The Coeff. fa is = (LTL + STL – DF – IFP – EL) / P.

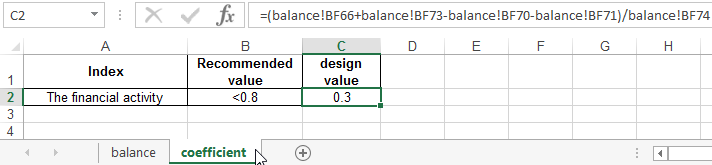

On the new balance sheet (line numbers):

The Coeff. fa = (page 1400 + page 1500 - Zoo - page 1530 - page 1540) / page 1700.

- LTL (page 1400) – is long-term liabilities (total for section 4).

- STL (page 1500) – is short-term liabilities (total for section 5).

- DF– is debt to the founders (in the old form – code 630, accounts payable, which is disclosed in the explanations).

- IFP (line 1530) – is the incomes of future periods.

- EL (page 1540) – is estimated liabilities.

Since the balance is in Excel, you can create a separate table in the new book (on a new sheet) to analyze the financial state of the enterprise. The coefficient of financial activity is simply calculated: the data is substituted into the formula from accounting reports by means of links to the cells with the desired values.

The value of the indicator is 0.3, but commitment in the capital structure occupies only about 30%. Financial stability of the company is high, but profitability is low. The enterprise should find the optimal ratio between its own and borrowed capital.

Download an example of CFA calculation in Excel

The coefficient values can be adjusted depending of the industry. When assessing the state of the business, the trend and dynamics of the change in the activity index are considered, plus making of the calculation of profitability, liquidity, turnover and other indicators.