Return On Equity – ROE in Excel

Return on equity (ratio) shows the intensity of enterprise internal funds use and characterizes its business activity. We can calculate this ratio by dividing the sales volume for a period (year) by the average annual equity value. The indicator is calculated from the balance sheet data.

Essence and meaning of the concept

The ratio which we are exploring is an indicator of the effectiveness of the company's resources management. The coefficient of return on equity reflects how many turns it takes to pay bills for the date of analysis.

The indicator is used to evaluate various aspects of the firm's activities:

- Commercial: shows how effective is the system for selling products (shows surplus or shortage).

- Financial: shows the company's dependence on borrowed current assets (the activity of use).

- Economic: the activity of financial resources which the depositor risks.

The increase in return on equity (ratio) indicates the growth of products sales. A significant increase in revenue from sales occurs most often due to the profit obtained through the use of borrowed funds. In the long term, such an approach will negatively affect the financial stability and independence of the enterprise.

Return on equity and formula in Excel

The ratio of capital turnover is the speed with which financial means pass the stages of production and circulation. The concept is characterized by two indicators: the coefficient itself and the duration of one turnover.

The formula for the Return on equity (ratio) (in turnovers):

Return on Equity = Net Income/Shareholder's Equity.

The formula on the balance sheet:

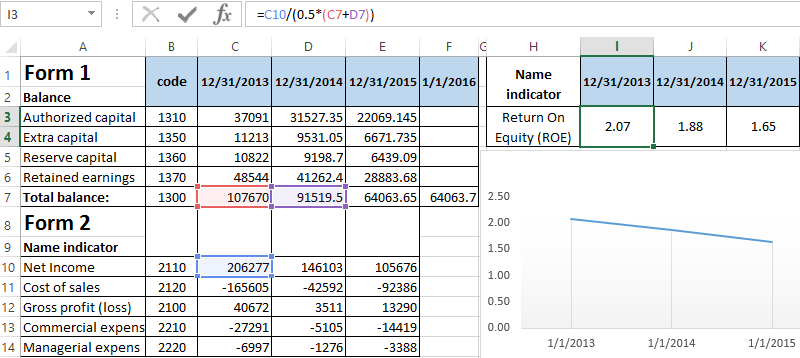

code 2110 / 0,5*( code 1300 b.p. + code 1300 e.p.)

The value in the numerator is code 2110 from form 2, in the denominator is the average value of the sum of the beginning of the period + the end of the period code 1300 from form 1.

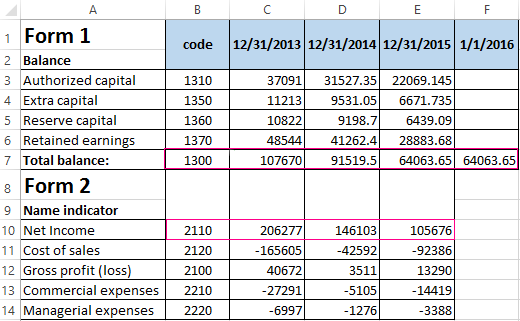

Let’s take for example the following data:

We calculate the return on equity (ratio) and display it on the chart:

If the return on equity (ratio) Decreased, so this means that capital is not being used effectively enough. Although for a more objective analysis it is necessary to compare with the standard indicators in the industry.

Standard value of the coefficient

The ratio of turnover is one of the coefficients of business activity: the adopted norm for the indicator does not exist. Each organization makes an analysis of the change in the coefficient in dynamics and compares it with the average values in the industry and also studies the factors which influence on the situation.

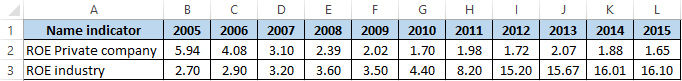

Analysis of return on equity (ratio) in the dynamics for Private company:

Below in the table, there are changes in the industry

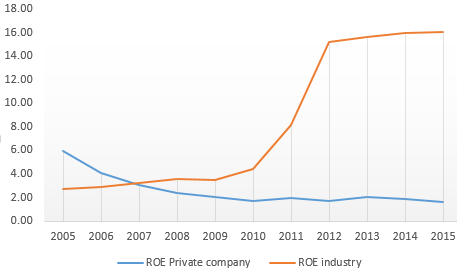

A chart with level dynamics:

Return on equity (ratio) at the enterprise is steady enough (though there is an insignificant decrease in a parameter till 2008). This indicates the stability of the company's sales system and talks about the effective use of internal funds in generating revenue.

But the same indicator for the industry since 2008 is higher. For a detailed analysis, you need an estimate of the turnover speed of other organization parameters.

Possible ways to accelerate the return on equity:

- additional marketing research aimed at accelerating sales (review of pricing policy, optimization of assortment, the study of demand, etc.);

- promotion of sales ("enhanced" advertising, promotions, discounts, sales, etc.);

- acceleration of goods shipment;

- intensification of production which will reduce the duration of the production cycle (for example, the introduction of new technologies);

- reduction of transport, storage, and other similar expenses;

- search for suppliers that provide deferment of payment.

The plan for optimizing the indicator depends on the obtained results of the analysis of the turnover of all parameters.