Excel Formula Return on Assets ROA and Return on Equity ROE

The Return on Assets (ROA) ratio measures the efficiency of using assets to generate income. For example, a company with a high ROA can generate the same profit with fewer assets or asset tranches as a company with a lower ROA.

Formula for Calculating Return on Assets (ROA) in Excel

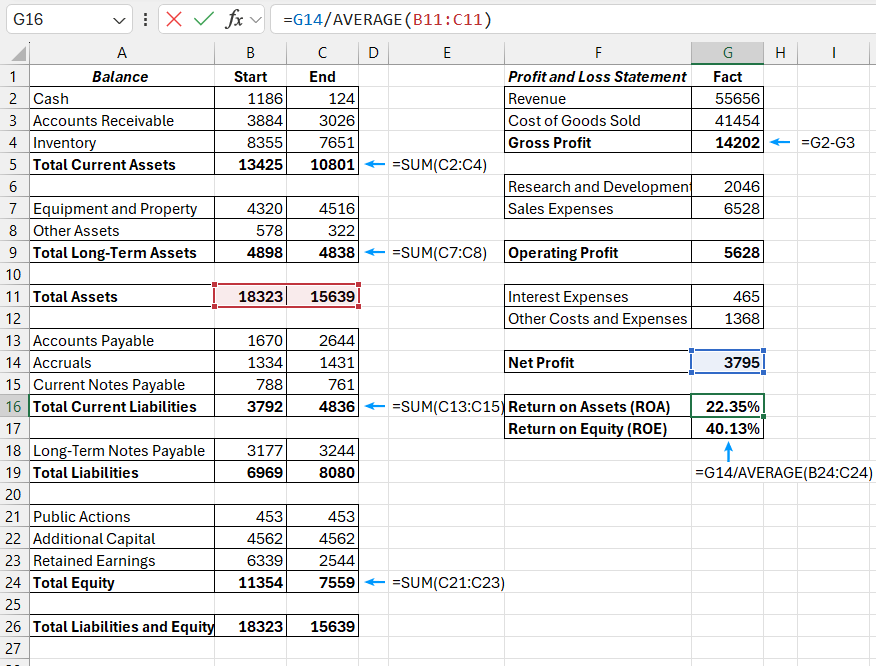

To calculate the ROA ratio, you need to divide the profit generated over the accounting period by the average value of assets at the beginning and end of the period. Below is an example of a balance sheet and ROA calculation in Excel:

Source data table:

| Balance | Start | End | Profit and Loss Statement | Fact | |

| Cash | 1186 | 124 | Revenue | 55656 | |

| Accounts Receivable | 3884 | 3026 | Cost of Goods Sold | 41454 | |

| Inventory | 8355 | 7651 | Gross Profit | 14202 | |

| Total Current Assets | 13425 | 10801 | Research and Development | 2046 | |

| Equipment and Property | 4320 | 4516 | Sales Expenses | 6528 | |

| Other Assets | 578 | 322 | Operating Profit | 5628 | |

| Total Long-Term Assets | 4898 | 4838 | Interest Expenses | 465 | |

| Total Assets | 18323 | 15639 | Other Costs and Expenses | 1368 | |

| Accounts Payable | 1670 | 2644 | Net Profit | 3795 | |

| Accruals | 1334 | 1431 | Return on Assets (ROA) | 22.35% | |

| Current Notes Payable | 788 | 761 | Return on Equity (ROE) | 40.13% | |

| Total Current Liabilities | 3792 | 4836 | |||

| Long-Term Notes Payable | 3177 | 3244 | |||

| Total Liabilities | 6969 | 8080 | |||

| Public Actions | 453 | 453 | |||

| Additional Capital | 4562 | 4562 | |||

| Retained Earnings | 6339 | 2544 | |||

| Total Equity | 11354 | 7559 | |||

| Total Liabilities and Equity | 18323 | 15639 | |||

Example of how to use a formulas in Excel:

ROA = Net Income / Average Total Assets

ROE = Net Income / Shareholders Equity

The numerator is net profit, taken from the income and expenses statement. The denominator uses the AVERAGE function to calculate the average value of assets for the accounting period.

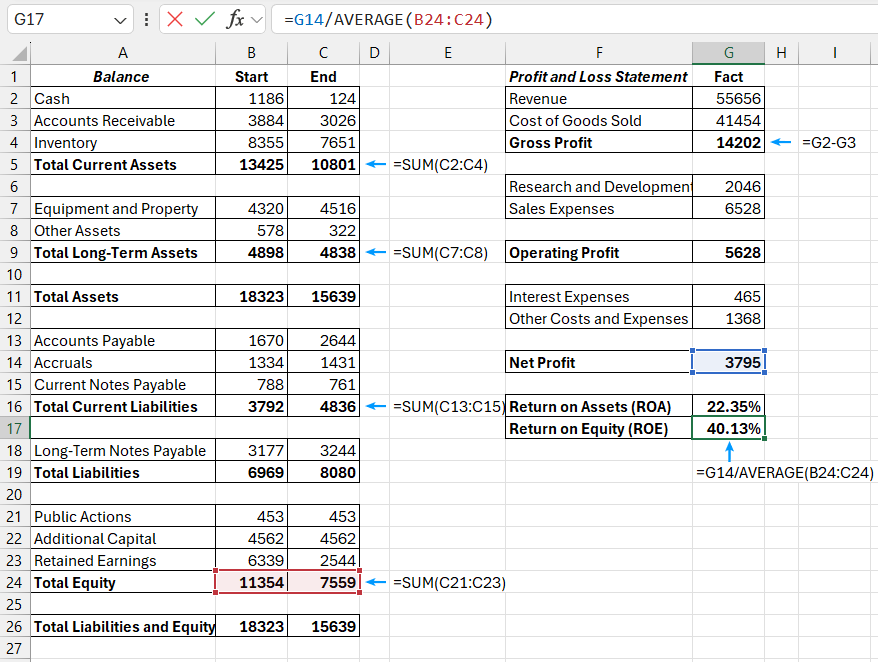

Formula for Return on Equity (ROE) in Excel

Another commonly used indicator of a company's financial performance is the Return on Equity (ROE) ratio. Investors use it to assess how efficiently their investments will be used. The formula for calculating ROE in Excel is shown below:

Download examples of Return on Assets and Return on Equity Formulas in Excel

Also read: Download Return on Equity Excel Template.

Similar to the previous example, the ROE ratio is calculated by dividing net profit by the average equity balance over the accounting period. However, in the ROE ratio, the average total equity is used instead of the average total assets.