Analyses of data of accounting and financial indexes are in Excel

A review of possibilities of spreadsheets is in financial analytic geometry, economy and business. Simple decisions of intricate problems with the use of graphic инфографики for visualization of results.Accounting and analysis of financial indexes

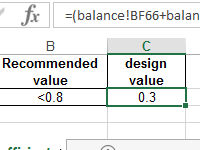

Calculation of the financial activity ratio in Excel.

Calculation of the financial activity ratio in Excel.The coefficient of the financial activity shows how much the enterprise depends on borrowed funds. It characterizes financial stability and profitability. How to calculate the indicator by the formula?

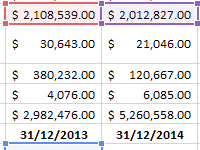

Financial analysis in Excel with an example.

Financial analysis in Excel with an example.The financial and statistical analysis in Excel: automation of calculations. How to analyze the time series and forecast sales, taking into account the trend component and seasonality?

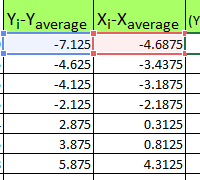

Coefficient of pair correlation in Excel.

Coefficient of pair correlation in Excel.The correlation coefficient (the paired correlation coefficient) allows us to discover the interconnection between the series of values. How to calculate the coefficient of pair correlation? The construction of the correlation matrix.

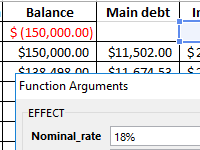

Calculation of the effective interest rate on loan in Excel.

Calculation of the effective interest rate on loan in Excel.Calculation of the effective interest rate on the loan, leasing and government bonds is performed using the functions EFFECT, IRR, XIRR, FV, etc. Let's look at examples of how real interest is considered.

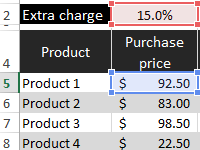

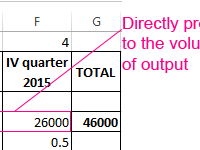

Budgeting of the enterprise in Excel with discounts.

Budgeting of the enterprise in Excel with discounts.Template for planning the budget of the trading company with the calculation of providing customers discounts. The main advantage is the ability to create loyalty programs with control over the company's profit. Management of discounts, their impact on margin.

Turnover ratio of receivables in Excel.

Turnover ratio of receivables in Excel.The factor of turnover of receivables shows the rate of conversion of goods sold into the money supply. Formula by balance, calculation of the indicator in days.

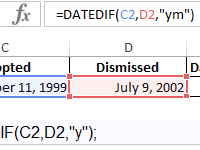

Program for calculation the seniority of work in Excel download.

Program for calculation the seniority of work in Excel download.The simplest functions and formulas that help to calculate the length of service in Excel. Automated universal table for calculating the length of service.

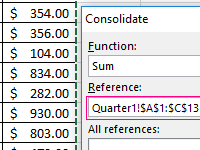

Data consolidating in Excel with examples of usage.

Data consolidating in Excel with examples of usage.Let's look at the example of practical work how to do data consolidation. Combining the ranges on different sheets and in different books. Consolidated report using formulas.

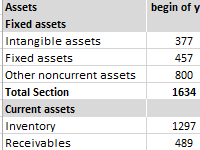

Example of construction the financial model of the enterprise in Excel.

Example of construction the financial model of the enterprise in Excel.Construction of financial model: order, features, examples of tables with calculations and formulas. Details on drawing up an investment plan, forecasting incomes and expenses.

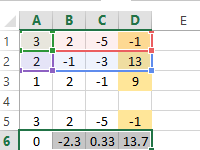

Solving equations in Excel using the Cramer and Gauss iterations method.

Solving equations in Excel using the Cramer and Gauss iterations method.Solving equations by different formulas, functions and computational tools. Examples of solutions by different methods: selection of the parameter, the method of Cramer, Gauss, iterations.