How to Calculate the Absolute Liquidity Ratio in Excel

The absolute liquidity ratio determines the portion of immediate liabilities that can be settled using cash and its equivalents (securities, bank deposits, etc.), in other words, through highly liquid assets.

Alongside other liquidity indicators, the absolute liquidity ratio is of interest not only to organizational management but also to external analysis entities. This ratio is significant for investors, banks in terms of quick liquidity, and suppliers of raw materials and goods concerning absolute liquidity.

Definition and Excel Formula

Absolute liquidity indicates an organization's short-term solvency: whether the firm can settle its obligations (with suppliers) using the most liquid assets (cash and its equivalents). The ratio is calculated as the ratio of financial resources to current obligations.

The standard formula looks as follows:

Absolute Liquidity = (cash + short-term investments) / current liabilities

or alternatively:

Absolute Liquidity = highly liquid assets / (most immediate liabilities + medium-term liabilities)

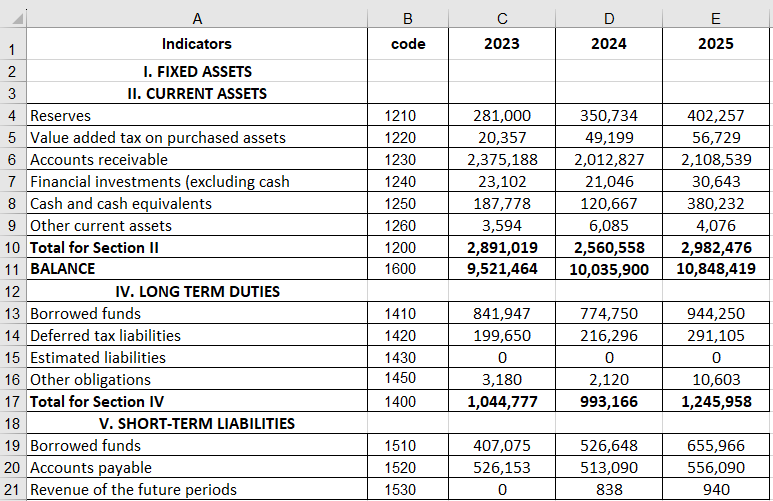

Data for the calculation is sourced from the balance sheet. Let's consider an Excel example.

We've highlighted the rows necessary for calculating the absolute liquidity ratio. The formula based on the balance is:

Absolute Liquidity = (code 1240 + code 1250) / (code 1520 + code 1510).

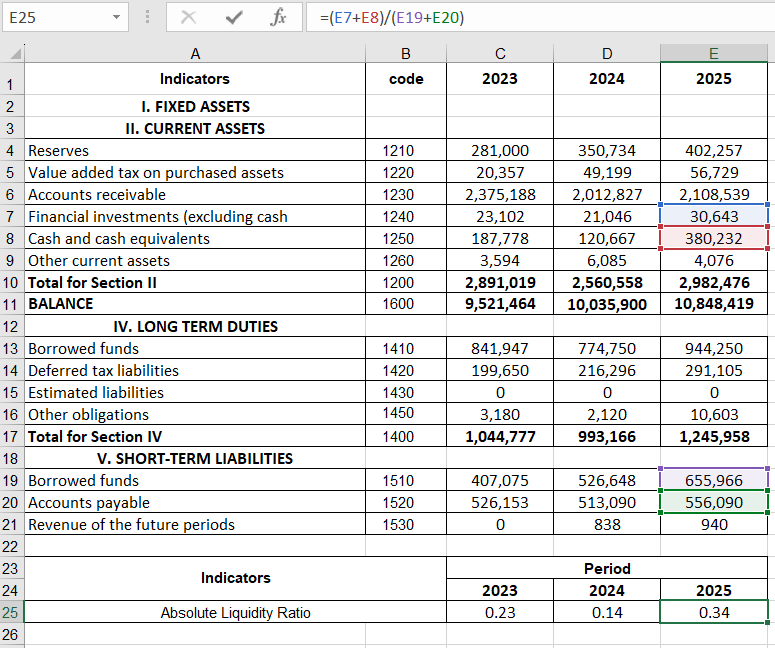

Excel Calculation Example:

Simply input the values of the corresponding cells into the formula as references.

Absolute Liquidity Ratio and Normative Value

The accepted international normative value for the ratio is > 0.2. The essence of this limit is that the enterprise must repay at least 20% of its current liabilities daily. The financial analysis practice in Russian companies follows similar principles, although the justification for this approach is lacking.

In Russian practice, the structure of short-term liabilities is inconsistent, with repayment terms varying significantly. Hence, considering 0.2 as a threshold is insufficient. For many companies, the ratio lies between 0.2-0.5.

If the absolute liquidity ratio falls below the norm:

- The enterprise cannot immediately settle debts with suppliers using all forms of cash (including proceeds from securities sales);

- Economists need to conduct further solvency analysis.

A significant rise in the absolute liquidity ratio indicates:

- An excessive portion of non-operational assets as cash in cash registers and bank accounts;

- A need for additional capital usage analysis.

Thus, a higher ratio indicates better company liquidity. However, excessively high values suggest inefficient cash utilization, with a substantial amount of financial resources not being invested effectively.

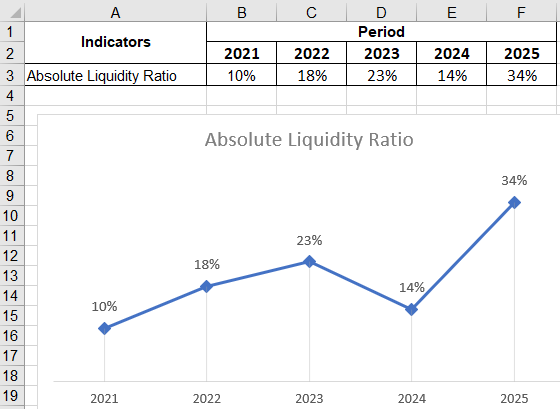

The absolute liquidity values for 2023 and 2025 are within the norm. However, the company faced challenges in settling short-term obligations in 2024.

To illustrate the indicator's dynamics, we display it graphically:

Download Absolute Liquidity Ratio Calculation Example in Excel

Download Absolute Liquidity Ratio Calculation Example in Excel

For comprehensive solvency analysis, all indicators of an organization's liquid current assets are computed. Using this ratio, the proportion of short-term obligations that can be immediately settled is determined. The example shows that the value increased by 0.24 from 2011-2025. In 2011, 2012, and 2024, the company faced solvency challenges. However, the situation normalized, and the enterprise can meet current obligations by 34%.